Breakdown of the 5 ideal-performing Dow Jones stocks August 2025

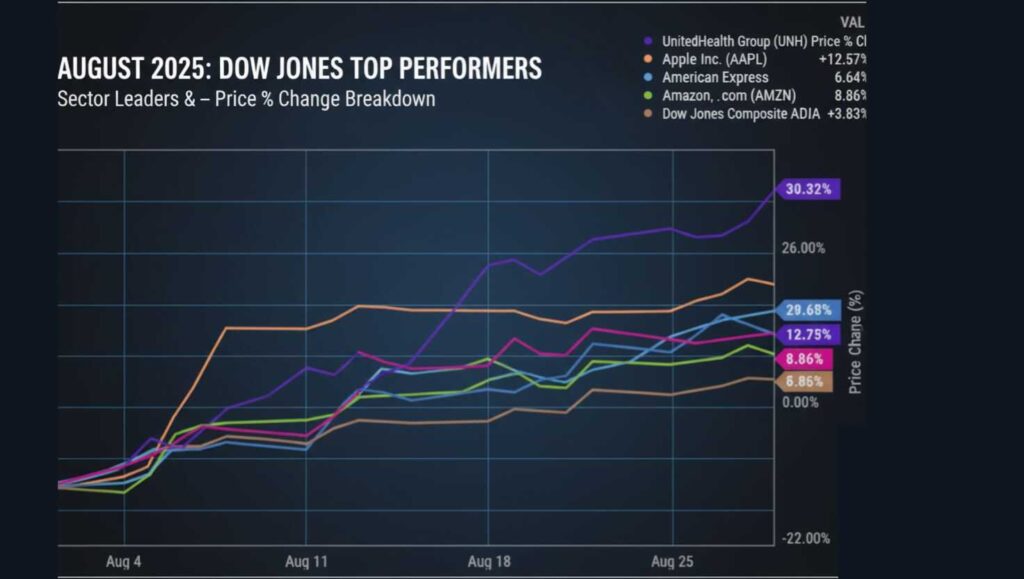

Breakdown of the 5 ideal-performing Dow Jones stocks August 2025: August 2025 proved to be an exceptional month for the Dow Jones Industrial Average, which posted a solid 3.8% gain amid mixed economic signals. While the index of 30 blue-chip companies demonstrated healthy overall performance, five standout stocks significantly outperformed the benchmark, delivering impressive returns ranging from 6.6% to over 30%. This article provides a comprehensive analysis of August’s top performers—UnitedHealth Group, Apple, American Express, Amazon, and Home Depot—examining the strategic moves, financial results, and market dynamics that propelled these companies to exceptional returns. Whether you’re a seasoned investor or market enthusiast, understanding these standout performances offers valuable insights into current market trends and potential future opportunities.

What was the Dow Jones in 2025?

If you’re wondering what was the Dow Jones in 2025, the answer lies in a year marked by volatility, tech-driven rallies, and shifting investor sentiment. Throughout 2025, the Dow Jones Industrial Average (DJIA) reflected the U.S. economy’s balance between strong corporate earnings and concerns over inflation, interest rates, and global trade. Blue-chip companies in technology, healthcare, and financials often led the index higher, while cyclical sectors experienced pullbacks. By the end of 2025, the Dow Jones became a key benchmark for investors tracking U.S. stock market performance, helping traders and analysts understand where opportunities and risks were emerging. For long-term investors, the index served as both a snapshot of economic resilience and a reminder of how quickly market trends can shift.

August 2025 Market Context: Setting the Stage for Outperformance

The Dow Jones Industrial Average’s 3.8% monthly gain came against a backdrop of evolving market conditions. While concerns about inflation persisted—with Core PCE increasing 2.9% in July, matching expectations but representing an acceleration from the previous month—investors remained cautiously optimistic about potential Federal Reserve rate cuts. The market’s performance was particularly notable given September’s historical reputation as a weak month for equities, with investors closely watching whether the August gains would prove sustainable heading into the final months of the year.

Here are the five companies that led the way in the Dow Jones Industrial Average and why they led the charge.

Beyond the Dow, other major indices also posted gains:

- The S&P 500 advanced approximately 1.9% for the month

- The Nasdaq Composite saw a 1.6% increase

- The Russell 2000 small-cap index significantly outperformed with almost 7% gains

Table: Major Index Performance in August 2025

| Index | Performance | Key Characteristics |

| Dow Jones Industrial Average | +3.8% | 30 blue-chip stocks, price-weighted |

| S&P 500 | +1.9% | 500 large-cap stocks, market-cap weighted |

| Nasdaq Composite | +1.6% | Technology-heavy, over 3,000 stocks |

| Russell 2000 | ~7.0% | Small-cap companies |

This varied performance across indices highlights how different market segments responded to August’s economic conditions and investor sentiment.

Go to Homepage

1. UnitedHealth Group (UNH): +30.3% – A Remarkable Recovery Story

The Turnaround Narrative

UnitedHealth Group delivered August’s most impressive performance among Dow constituents, surging 30.3% after a challenging year that had seen its stock decline approximately 50% heading into the month. This dramatic reversal was fueled by two major catalysts that renewed investor confidence in the healthcare giant.

High-Profile Investor Confidence

The most significant boost came from revelations that Warren Buffett’s Berkshire Hathaway had established a $1.5 billion position in UnitedHealth, acquiring approximately 5.04 million shares. This move was particularly noteworthy given Berkshire’s own insurance operations (GEICO), signaling Buffett’s confidence that UnitedHealth had been oversold. Adding to the bullish sentiment, Michael Burry of “The Big Short” fame disclosed through his Scion Asset Management hedge fund the purchase of 20,000 UnitedHealth shares plus an additional 350,000 call options.

Solid Fundamental Performance

Beyond the high-profile investments, UnitedHealth’s operational performance provided fundamental support for the recovery:

- Q2 revenue of $111.6 billion, representing a $12.8 billion year-over-year increase

- Full-year revenue guidance between $344 billion and $345.5 billion, which would mark a 15% increase from 2024 levels

Despite these positive developments, it’s worth noting that UnitedHealth remained down approximately 48% from its April 2025 peak, suggesting potential for further recovery if the company can continue executing its turnaround strategy.

2. Apple Inc. (AAPL): +14.7% – Innovation and Strategic Pivots

Beyond Buffett’s Sell-Off

Apple delivered a impressive 14.7% gain in August despite Warren Buffett reducing Berkshire Hathaway’s position by 20 million shares. The sell-off provided Buffett with capital for his UnitedHealth investment but didn’t deter broader investor enthusiasm for Apple’s stock.

Strong Financial Performance

Apple’s robust performance was underpinned by better-than-expected quarterly results:

- Fiscal Q3 revenue of $94 billion (ended June 28), representing 10% year-over-year growth

- Earnings per share of $1.57, a 12% increase from the previous year

- Double-digit growth across key segments including iPhone, Mac, and Services

These results were particularly significant given Apple’s relatively flat revenue trajectory since 2023, demonstrating the company’s ability to reinvigorate growth through product innovation and services expansion.

Strategic Tariff Protection

Another key factor in Apple’s August performance was its announcement of an additional $100 billion investment in American manufacturing capacity, bringing its total commitment to $600 billion. This strategic move effectively immunized its iPhone production from potential import tariffs, addressing a significant concern that had weighed on investor sentiment.

3. American Express (AXP): +12.6% – Premium Positioning Pays Off

Distinctive Business Model Advantages

American Express continued to leverage its unique position in the financial services sector, gaining 12.6% in August. Unlike competitors Mastercard and Visa, American Express operates a closed-loop system that provides distinct advantages: – Own payment network providing greater control over transactions – Lending operations that generate interest income alongside processing fees – Premium customer focus targeting corporate accounts and affluent consumers.

Strong Quarterly Results

The company’s fundamental performance supported its August appreciation:

- Q2 revenue of $17.8 billion, representing 9% year-over-year growth

- Adjusted EPS of $4.08, a 17% increase from Q2 2024

- Continued recovery in consumer spending, particularly among its premium customer segments

Strategic Initiatives for Future Growth

Looking beyond current results, American Express demonstrated forward-thinking strategy with plans to enhance its Platinum card offerings specifically targeted at attracting Generation Z and millennial customers. This demographic focus positions the company well for sustained long-term growth as spending power shifts toward younger generations.

4. Amazon.com (AMZN): +6.6% – Multiple Growth Engines Firing

Cloud Leadership Driving Profitability

Amazon posted a solid 6.6% gain in August, fueled by the continued outstanding performance of its Amazon Web Services (AWS) division:

- Q2 AWS revenue of $30.87 billion

- AWS operating income of $10.16 billion

- Continued dominance in cloud infrastructure services

AWS remains Amazon’s most profitable segment and continues to benefit from enterprise demand for cloud computing and artificial intelligence capabilities without the massive capital investment required for private data centers.

Diversified Revenue Streams

Beyond cloud computing, Amazon demonstrated strength across multiple business units:

- Advertising services revenue reached $15.69 billion in Q2, representing 23% year-over-year growth

- Record-breaking Prime Day event in July generated an estimated $23.8 billion in overall sales according to Adobe Analytics

- E-commerce operations continued to expand despite already massive scale

This diversification provides Amazon with multiple growth vectors beyond its core retail operations, making it uniquely positioned to capitalize on various digital transformation trends.

5. Home Depot (HD): +8.8% – Adapting to Evolving Market Conditions

Shifting Housing Market Dynamics

Home Depot rounded out the top five with an 8.8% August gain, driven by strategic adaptation to changing housing market conditions. With home sales struggling throughout 2025, CEO Ted Decker noted that more homeowners were investing in “smaller home improvement projects” rather than trading up to new properties.

Solid Quarterly Performance

The company’s fundamental results supported its stock appreciation:

- Q2 sales of $45.3 billion, representing 4.9% year-over-year growth

- Adjusted EPS of $4.68, slightly above the previous year’s results

- Reaffirmed full-year guidance of 2.8% sales growth for 2025

Resilient Business Model

Home Depot’s performance demonstrates the resilience of its business model amid shifting housing trends. While new home sales remained challenged, the company successfully capitalized on the trend toward home improvement and renovation among existing homeowners—a strategy that positioned it well for continued success even in a less robust housing market.

Table: Summary of Top 5 Dow Performers in August 2025

| Company | Ticker | Performance | Key Catalyst |

| UnitedHealth Group | UNH | +30.3% | Berkshire Hathaway investment, strong earnings |

| Apple | AAPL | +14.7% | Better-than-expected earnings, US manufacturing expansion |

| American Express | AXP | +12.6% | Premium customer focus, strong financial results |

| Amazon | AMZN | +6.6% | AWS growth, advertising expansion, record Prime Day |

| Home Depot | HD | +8.8% | Shift to home improvement projects, solid earnings |

Investment Insights: Key Takeaways from August’s Top Performers

Quality Companies With Catalysts

August’s top performers shared several common characteristics that drove their outperformance:

- Strong fundamental results: Each company reported ideal-than-expected financial performance or guidance

- Strategic positioning: Sector leaders capitalized on their competitive advantages

- Catalyst-driven: Specific events (investments, product announcements) accelerated performance

- Quality operations: Despite market challenges, these companies demonstrated operational excellence

Sector Diversification

The diversity of sectors represented among the top performers—healthcare, technology, financial services, retail, and home improvement—suggests that August’s gains were broad-based rather than concentrated in a single industry. This sector diversification indicates healthy market momentum across multiple segments of the economy.

Looking Ahead: September 2025 and Beyond

As markets transition into September—historically the weakest month for equities—investors will be watching whether August’s top performers can sustain their momentum. Key factors to monitor include:

- Federal Reserve policy decisions regarding interest rates

- Continued inflation trends and their impact on consumer spending

- Company-specific execution of strategic initiatives announced during earnings season

- Broader economic indicators that might influence sector performance

While past performance doesn’t guarantee future results, August’s top performers demonstrated fundamental strengths and strategic positioning that could support continued success throughout the remainder of 2025.

Conclusion: Lessons from August’s Standouts

August 2025 offered a compelling narrative of recovery, adaptation, and strategic excellence within the Dow Jones Industrial Average. From UnitedHealth’s remarkable rebound fueled by legendary investors to Apple’s strategic manufacturing shift, American Express’s premium market focus, Amazon’s diversified growth engines, and Home Depot’s adaptation to housing market shifts—these companies demonstrated how strong fundamentals combined with catalytic events can drive exceptional performance.

For investors, these performances highlight the importance of focusing on quality companies with sustainable competitive advantages, strong leadership, and the ability to adapt to evolving market conditions. While short-term market movements can be unpredictable, the long-term trajectory of well-positioned companies with solid fundamentals remains the most reliable path to investment success.

As always, investors should conduct their own due diligence and consider their individual financial situations and risk tolerance before making investment decisions. The companies highlighted here represent August’s top performers, but market leadership can change rapidly based on evolving economic conditions and company-specific developments.